(updated 4pm - Sunday - April 26, 2020)

We have reinstated the Day Trade Margins for the CME Stock Indices during BOTH US Day and Overnight Session.

Here is the link to view DayTrade Margins for All Markets:

The risk of CME Stock Indices triggering Trading HALT for a long period of time during the Overnight Session is still present, but we want our customers to be able to trade with normal Day Trade Margins during the overnight sessions, so we are implementing this rule:

If the market gets close to the Daily CME Limit Halt Price, we will require your account balance to meet Exchange Maintenance Margins (listed on the Margins Page) or we will attempt to close your OPEN positions before the CME Market Limit Market Halt is Triggered.

Here is the CME Market Limit Market Halt Liquidation Trigger for Each of the CME Major Indices:

E-mini S&P 500 (ES) & Micro E-mini S&P 500 (MES): 8 points from CME Limit Price

E-mini NASDAQ 100 (NQ) & Micro E-mini Nasdaq-100 (MNQ): 25 points from CME Limit Price

Dow Jones $5 Mini (YM) & Micro E-mini Dow (MYM): 100 points from CME Limit Price

Russell 2000 Index Mini (RTY) & Micro E-mini Russell 2000: 5 points from CME Limit Price

VERY IMPORTANT - Your responsibility and Your Acceptance of the risk in trading during them extreme market conditions. You are solely responsible for any trading losses including if any debit balances are occurred. If markets trigger price limit market halts, no new orders are executed. If you are stuck in an Open Position, you are at the mercy of the next market open price. By YOU placing orders - you are Fully Accepting this Risk. The above AMP Risk CME Market Limit Market Halt Liquidation Trigger does NOT in any way guarantee against your trades generating negative balance. This is only a risk management tool to help our customers trade with normal Day Trade Margins during the US Overnight Session. Any trading PnL, both positive and negative, you are 100% responsible.

Another known risk is the market trades to the CME Market Limit Market Halt Liquidation Trigger Price and AMP Risk closes your open position and the market does NOT continue to trade to the CME Limit Halt Price. This is out of our control, we do NOT know what the markets will do...we just need to have prudent risk management in order to allow normal Day Trade Margins during the US Overnight Session. If this happens, and you want to re-enter your position, you will need to wait until the market is back beyond the above CME Market Limit Market Halt Liquidation Trigger Prices Range.

If you do not accept this risk or these AMP Risk Management Rules, DO NOT PLACE ANY NEW TRADES.

--------------------------------------------------------------------------------------

(updated 8am - Monday - April 13, 2020)

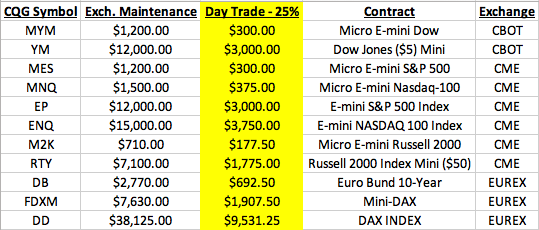

DayTrade Margins Reduced Back to Standard for CME and EUREX Major Stock Indices

We have adjusted All Markets Day Trade Margins for US Day Session: 8:30am - 4pm CST

Here is the link to view DayTrade Margins for All Markets:

VERY IMPORTANT - Your responsibility and Your Acceptance of the risk in trading during them extreme market conditions. You are solely responsible for any trading losses including if any debit balances are occurred. If markets trigger price limit market halts, no new orders are executed. If you are stuck in an Open Position, you are at the mercy of the next market open price. By YOU placing orders - you are Fully Accepting this Risk. If you do not accept this risk, DO NOT PLACE ANY NEW TRADES.

--------------------------------------------------------------------------------------

(updated 7am - Tuesday - March 31, 2020)

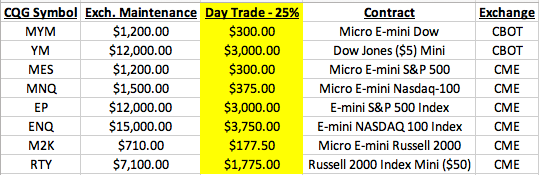

We have adjusted the following Day Trade Margins for BOTH Day and Overnight Session (except the CME Stock Indices during the Overnight Session will remain at 100% Exchange Maintenance Margins).

Here is the link to view DayTrade Margins for All Markets:

VERY IMPORTANT - Your responsibility and Your Acceptance of the risk in trading during them extreme market conditions. You are solely responsible for any trading losses including if any debit balances are occurred. If markets trigger price limit market halts, no new orders are executed. If you are stuck in an Open Position, you are at the mercy of the next market open price. By YOU placing orders - you are Fully Accepting this Risk. If you do not accept this risk, DO NOT PLACE ANY NEW TRADES.

--------------------------------------------------------------------------------------

(updated 2pm - Friday - March 27, 2020)

We have adjusted All Markets Day Trade Margins for BOTH Day and Overnight Session (except the CME Stock Indices during the Overnight Session will remain at 100% Exchange Maintenance Margins).

- Reason for CME Stock Indices Overnight Session remaining at 100% maintenance margin is too the high risk of limit market moves - triggering Trading HALT for a long period of time. Other Exchanges, such as EUREX does NOT have these limit Trading HALTs, so continue trading is available - thus reducing the risk of our customers getting stuck in Open Positions that can not be closed.

We are actively monitoring market conditions - and will continue to reduce our Day Trade Margins as soon as market conditions settle.

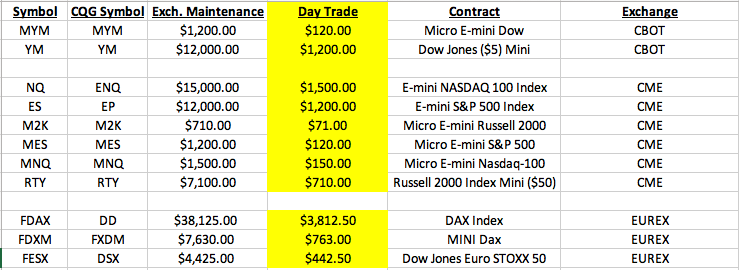

Here are the specific CME Stock Index Margins (Exch. Maintenance during Overnight Session)

Here is the link to view DayTrade Margins for All Markets:

--------------------------------------------------------------------------------------

(updated 8am - Monday - March 19, 2020)

Due to the Extreme Market Conditions, while taking into consideration our customers need to hedge their stock portfolio - we will make the following Margins Available during the US Day Session.

These be in effect on all trading platforms during the US Day Session: 8:30am - 4pm CST.

We will maintain as long as market conditions allows. If any changes, we will update this post and send email notice to all clients.

VERY IMPORTANT - Your responsibility and Your Acceptance of the risk in trading during them extreme market conditions. You are solely responsible for any trading losses including if any debit balances are occurred. If markets trigger price limit market halts, no new orders are executed. If you are stuck in an Open Position, you are at the mercy of the next market open price. By YOU placing orders - you are Fully Accepting this Risk. If you do not accept this risk, DO NOT PLACE ANY NEW TRADES.

Overnight Session time: 5:00 pm CST (Chicago Time) to 8:30am CST. We will continue to require 100% Exchange Maintenance Margin.

We are doing our best to help our customers - while maintaining prudent risk management.

--------------------------------------------------------------------------------------

(updated 8am - Monday - March 17, 2020)

Due to the Extreme Market Conditions, we have decided to maintain Exchange Maintenance Margin for BOTH Day & Overnight Sessions. This will remain in effect until we send out notice that is has changed. See Exchange Maintenance Margins: https://www.ampfutures.com/trading-info/margins/

For example:

- If your Account Balance is lower than $9K required for ES, you can trade the MES for $900.

- If your account balance is less than $900 - you can make a deposit to bring your account balance above $900, so you can trade MES.

--------------------------------------------------------------------------------------

(updated 10am - Monday - March 16, 2020)

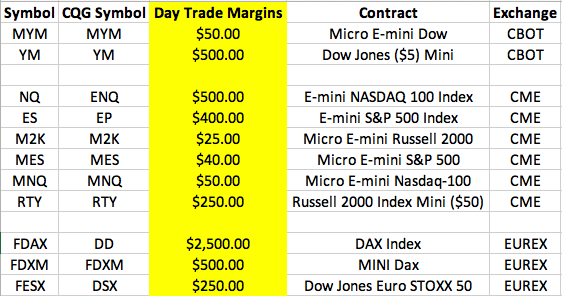

We have set adjusted back to our Current Double Day Trade Margins (Policy) - For the Major Indices:

ES, NQ, YM, RTY, MES, MNQ, MYM, M2K, FDAX, FDXM

For example, our standard day trade margins for ES is $400 per contract > ES will be $800 per contract.

This will be applied across all trading platforms.

Please view our current Day Trade Margins X 2 (double) for the amount required for each contract during this temporary increase.

https://www.ampfutures.com/trading-info/margins/

--------------------------------------------------------------------------------------

(updated 8am - Monday - March 16, 2020)

Last night the US Indices quickly triggered Limit Down Price Trading Halt.

Due to this extreme price action, we are going to extend the current Maintenance Margin requirements for the US Day Session.

We will continue to monitor the current market conditions, We need to see the market open before making any decisions about margin adjustments.

The current market conditions are too extreme for us to try to guess, We need to trust the Exchange Margin Calculation is appropriate for these current market conditions.

Here is our current risk management action plan:

We have set the margins requirements for the Night & Day Session to 100% of the Exchange Maintenance Margin Requirements:

Overnight Session time: 5:00 pm CST (Chicago Time) to 8:30am CST.

During the Overnight Hours, there is a 5% Price Limit - Set by the Exchange. If this Price limit is triggered, there is a very high chance of large price gap when the market re-open at 8:30am CST (markets could be in limit trade HALT for many hours - no ability to close Open Positions). This is why we are adjusting the margins to the exchange requirements during the night session.

Depending on the Market Conditions, we plan on adjusting the margins back to our current double day trade margin requirements during the US Day Session Trading Hours. (We will send out notice once any adjustments are completed) There are still market Price Limits during the US session, but the trading HALT is only 15 minutes (unless the max 20% Price Limit Down only is reached).

Until Markets Settled down, we are going to provide quick reference - CME Price Limits for Major Equity Indices (updated daily) - on this page: https://news.ampfutures.com/cme-price-limit-guide-trading-halted-levels-mar-2020

Current Double Day Trade Margins (Policy)

For example, our standard day trade margins for ES is $400 per contract > ES will be $800 per contract.

This will be applied across all markets and all trading platforms.

Please view our current Day Trade Margins X 2 (double) for the amount required for each contract during this temporary increase.

https://www.ampfutures.com/trading-info/margins/

If you need any assistance – please contact us via Phone or Live Chat: https://www.ampfutures.com/contact-us/

Related Posts

Temporary Margins Increase (RESTORED) Georgia Senate Election

January 6, 2021

Day Trade margin requirements have been restored (Back to Normal)

Temporary Margins Increase – CME Major Stock Indices (RESTORED to Standard Margins)

Temporary Margins Increase - Energies Complex

(updated 4pm - Sunday - May 10, 2020)

We have reinstated the Day Trade Margins for the Energies...