StockSharp Trading Platform Key Features

StockSharp (shortly S#) – are free programs for trading at any markets of the world (American, European, Asian, Russian, stocks, futures, options, Bitcoins, forex, etc.). You will be able to trade manually or automated trading (algorithmic trading robots, conventional or HFT).

Available connections: FIX/FAST, BarChart, CQG, IQFeed, LMAX, MatLab, Rithmic and many other.

Sign Up Today

StockSharp Key Features

S#.Designer

#.Studio (at the stage of beta-testing) – free software to trade at all markets (American, European, Asian, Russian; stock, futures, options, bitcoins, forex, etc.). You will be able to trade manually or automated trading (algorithmic trading robots, conventional or HFT).

Lots of connections: FIX/FAST, CQG, LMAX, Rithmic, IQFeed and many other.

Trade chart

Chart trading – just one mouse click.

Over 70 technical analysis indicators.

A handy order book (scalpers’ manager), algorithmic orders are available.

Any broker or partner broker (benefits).

Direct access to electronic board or brokerage system (DMA, HFT).

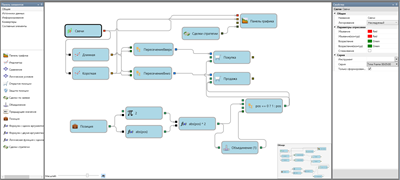

Visual strategy designer

Tests and optimizes history data (candlesticks, ticks, order books, order logs).

Real-data simulator.

Complex schemes of algo.

Built-in debugger.

Designs indices

with math formulas.

Arbitrage and pairs trading.

Continuous futures.

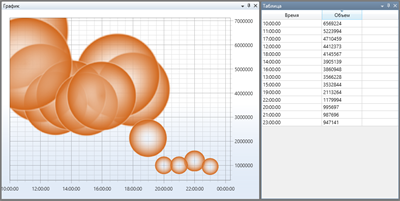

Visual analysis

of market data.

Build-in script editor.

Works with any market data.

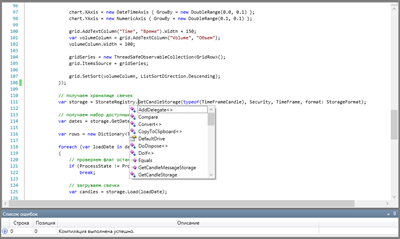

Built-in C# code editor

to create complex strategies.

Auto-complete mode and highlighted errors.

Loading strategies from “black box” (dll).

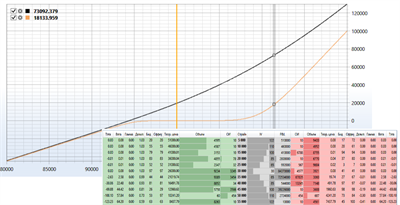

Options trading

Option desk with all “Greeks” (Black Scholes and Black models).

Visual option position analyzer.

Automated hedging (delta-hedge, vega-hedge).

Quoting options by volatility for all strikes.

S#.Data (Hydra) – free software to automatically load and store market data.

A great choice of market data sources: Yahoo Finance, Quandl, FinViz, FIX/FAST, LMAX, DukasCopy, TrueFX, Oanda, MBTrading, GainCapital, Rithmic, Blackwood/Fusion, Interactive Brokers, OpenECry, Sterling, IQFeed, E*Trade, BTCE, BitStamp and many other.

Supports all markets (American, European, Asian, Russian; stock, futures, options, bitcoins, forex, etc.).

History and real-time market data of all types (candlesticks, level1, level2, ticks, order books, order logs, open interest (OI), options, bonds and many other types).

Supreme data compression (TWO bytes for a transaction, SEVEN bytes for an order book).

Stores data as either .bin or classical .csv .

Data backup.

Friendly data copy (Windows Explorer).

Export

Export / import to several formats (.csv, Excel, .xml, directly to database).

Allows convert one-type data to another (e.g., ticks to candlesticks).

Can be started as a stand alone server.

Scheduled operation.

Simple integration with S#.Studio and S#.API.

Program access to stored data via API.

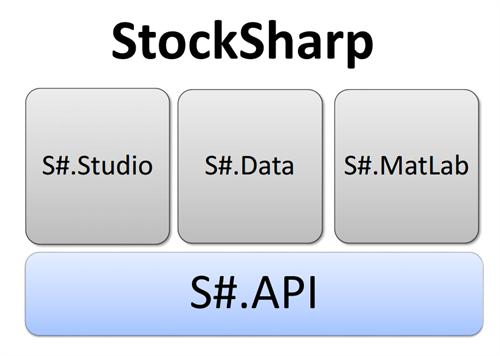

S#.API is a free library both for beginners and for experts in algorithmic trading.

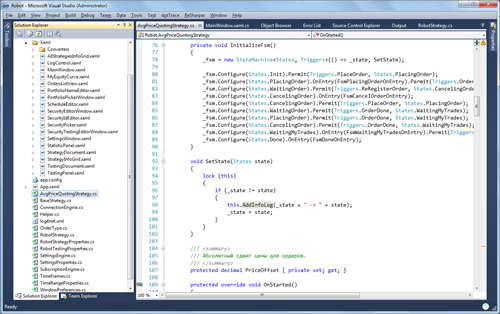

S#.API has been designed for C# programmers who use Visual Studio. S#.API lets you create any trading strategy, from long-timeframe positional strategies to high frequency strategies (HFT) with direct access to the exchange (DMA).

All our products are based on S#.API. Using it, we created such solutions as S#.Studio and S#.Data. Our integration tools S#.WealthLab and S#.MatLab are based on S#.API, too.

Advantages of using S#.API:

- Cross platform solution — If your robot doesn’t depend on any particular broker’s or exchange’s API, you can use any connection. For example, you can easily switch from Interactive Broker to E*TRADE, or from Forex to a stock exchange.

- Support for all markets — You can trade on NASDAQ, NYSE, or CME, having full support for spot market, futures, and options.

- Versatility — When developing S#.API, we focused on the needs of individual algo traders, small teams, investment companies, and banks.

- High performance — You can backtest hundreds of strategies based on different instruments.

- Low Latency — Processing an order takes just a few microseconds.

- Direct connection — Trade is conducted via a direct connection to the exchange. Moreover, you can use the FIX protocol.

- Realistic testing — We provide the most accurate testing for ticks and order books, as well as determine the actual slip.

- Popular development tools — You can use Visual Studio to create your own applications in C#.

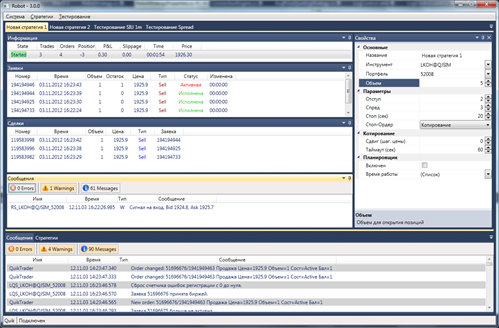

S#.Shell — save time by using a ready-made solution!

A ready-to-use shell (connection, configuration, testing, statistics) for your algo strategy, provided with the C# source code.

If you create ready-to-use algo strategies or want to test an algo idea without spending your time on creating a graphical shell, S#.Shell is your best solution!

S#.Shell is a simplified version of S#.Studio. You can quickly modify its C# source code (you only need basic programming skills for doing that).

The regular price of S#.Shell is $485, but you can get it as a free bonus if you buy the S# courses!

Main features of S#.Shell:

- A ready-to-use, “turn-key” robot with an example of a simple algo strategy (for those who want to learn algo trading on someone else’s source code).

- Complete source code. Perfect for creating customized algo strategies for someone or for yourself.

- Connect to any terminals or gateways (Quik, Alfa-Direct, SmartCom, Plaza II, etc.).

- Flexible user interface with dockable windows (like in Visual Studio 2012)

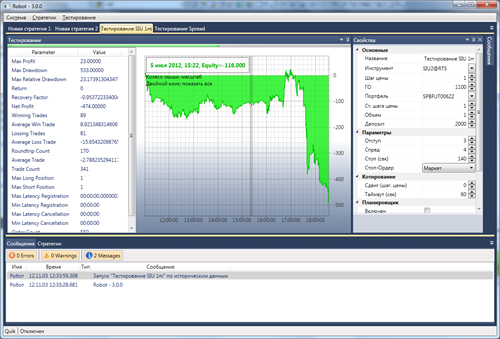

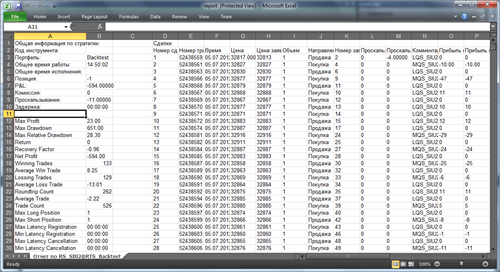

- Strategy testing (statistics, equity, reports).

- Save and load strategy settings.

- Launch strategies in parallel.

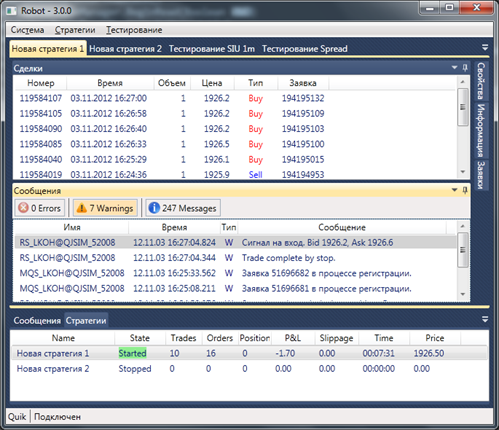

- Detailed information on strategy performance (orders, transactions, position, revenue, logs, etc.). Everything is simple and easy to understand.

- Launch strategies on schedule.

- Low memory usage.

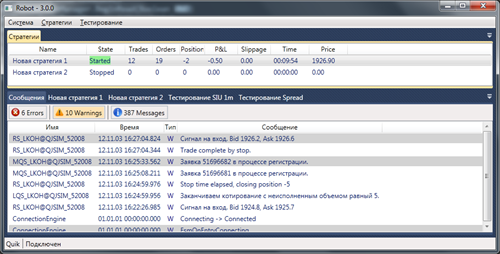

S#.Shell — Trading mode

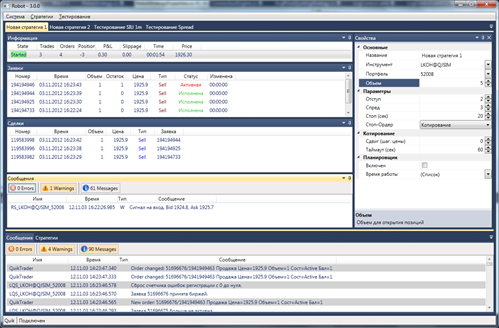

S#.Shell — Testing mode

S#.Shell — Flexible user interface

S#.Shell — Easy to use

S#.Shell — Testing report

S#.Shell — Complete source code

Most Recent Blog Posts

US Martin Luther King Day Holiday Trading Schedule (2025)

Jan 17, 2025by AMP Futures

US National Day of Mourning for Former President Jimmy Carter

Jan 7, 2025by AMP Futures