CME Exchange Fee Increase (Effective February 1, 2025)

Effective February 1, 2025, Chicago Mercantile Exchange Inc. (“CME”), The Board of Trade of the City of Chicago, Inc....

Hidden Force Flux is powered by our institutional-grade proprietary algorithm.

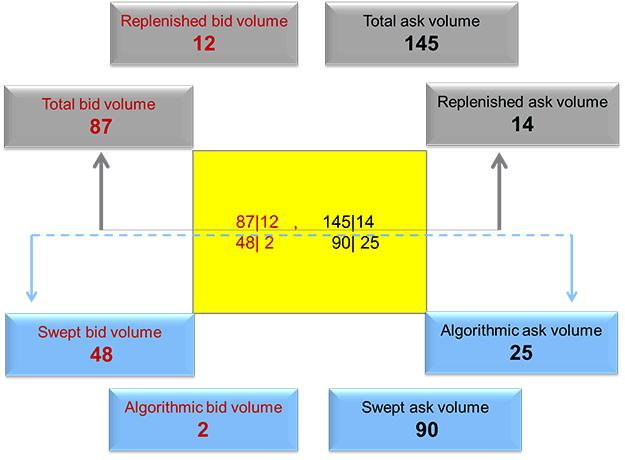

Replenished:

Swept:

Algorithmic:

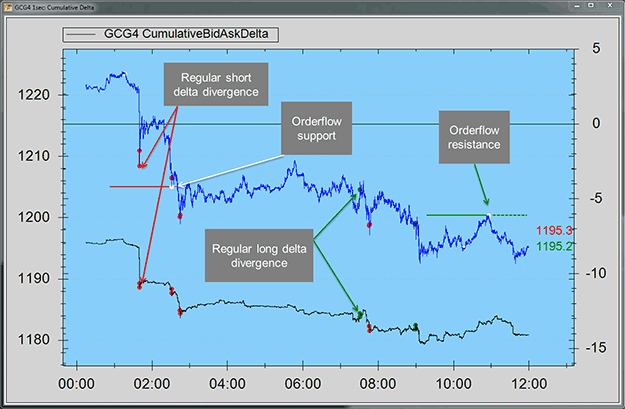

The concepts of ‘localized delta divergence’, ‘orderflow support/resistance’ are explained in Owner’s Manual which becomes available when you download and install the software.

Note: just to further clarify our concept of ‘localized delta divergence’ is different from the usual delta divergence you may be familiar with and is based on our proprietary computation.

Jan 31, 2025by AMP Futures

Jan 17, 2025by AMP Futures

Jan 7, 2025by AMP Futures