Order Types

Orders can be buy orders, sell orders or spread orders. They are relayed to a firm’s desk on the trading floor either by telephone, by teletype or electronically. Orders taken by telephone will be written either as sell (right side of order form) or a buy (left side of order form), or as a spread (on both left and right sides).

Each commodity has certain designated delivery months. These delivery months and the commodity itself have specifically designated symbols that are included on each order.

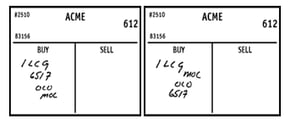

This means that the June 2004 cattle contract might be trading at the same time as a June 2003 cattle contract. The June 2004 contract is referred to as “red June,” or LCM4. A runner must be careful not to confuse the two contract months. Below is a sample order.

There are several types of orders that are commonly used in the futures industry.

Day Orders/Open Orders (GTC)

All orders are either “day” or “open” (also called GTC – “good-’til-canceled”) orders. A day order automatically expires if it is not executed during the trading session it was entered. An open order will remain in effect until filled, canceled, or until the contract expires. Open or GTC orders should be marked as such. Some brokerage firms have pre-printed order forms which indicate either OPEN or GTC. Check with your firm regarding their policy on open or GTC orders.

Market Orders

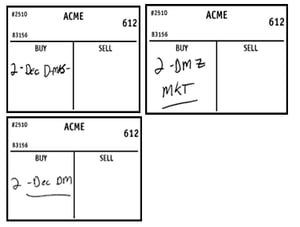

A market order is to be filled at the best available price immediately upon receipt by the broker. Shown below are examples of three different ways of writing a market order.

This order is interpreted as follows: “For account 83156, Buy 2 December Deutsche marks at the market.” It is important to recognize that there are at least three ways to write a market order.

Limit Orders

A limit order is one that can be executed only at a specified price or better during normal market conditions.

In the above example which reads to “buy 2 February Live Cattle at 65.17” it is understood that the order will be filled at 65.17 or any price lower than 65.17. It cannot be filled at any price higher than 65.17, or an error will result.

This particular order tells the broker to sell 3 February Lean Hogs at 78.65 or any price higher than 78.65. Any fill lower than 78.65 will cause an error. CXL Orders (Cancellation Orders)

An order to cancel (CXL) instructs the broker to remove a previously entered order from his deck. This may also be called a “straight cancel,” which means the order being cancelled is not being replaced with another order. When a cancel order is delivered to the broker, both the cancel order and the order being cancelled must be returned to the order entry desk. To facilitate cancellation of an order, the cancel order will also state the order ticket number of the order being cancelled. The runner must make sure that the correct order is removed from the broker’s deck.

This order instructs the broker to cancel former order number 2508 to buy 5 June Deutsche marks at .6483. The CXL is repeated on the cancellation order so the broker does not mistake it for a new limit order.

CRO Orders (Cancel Replace Order)

A CRO order is an order entered to replace one already in the broker’s deck. This one order does the work of two, and is an easy way of writing a new order while canceling an old order.

This order instructs the broker to buy 5 April Feeder Cattle at 68.55 and cancel order number 193 to buy 5 at 68.30.

Stop Orders

A stop order is one that becomes a market order if and when the market reaches a designated price. A “buy stop” is placed above the market and becomes a market order when the commodity trades at or is bid at or above the specified stop price. A “sell stop” is placed at a price below the market. It becomes a market order when the commodity trades at or is offered at the stop price or below.

To execute this buy stop order, the market must be trading at (or bid) above .7453 or bid there.

To execute this sell stop order, the market must be trading at (or offered) below .7460. MOC Orders (Market On Close)

An MOC order instructs the broker to fill the order at the market during the close, which is the last 30 seconds of trading (60 seconds in financials). The order must be filled at a price that falls within the closing range. In the example below, if the closing range was 8678 to 8682, the price at which the order was filled would have to be 8678, 8679, 8680, 8681 or 8682. Any other price would cause an error.

Stop Limit Orders

A stop limit order is a stop order which becomes a limit order if and when the market reaches a designated price.

In the above example, the broker is instructed to buy 1 December S&P when the price of 757.60 is reached, but not at a price above 757.70.

Another type of a stop limit order can be seen in the example above. This order instructs the broker to sell 1 March S&P at 746.50 stop limit; the stop and limit being the same price. This means that the broker must sell the order at the stated price, or a higher price, once the stop limit price is reached. If it is not reached again, the order is reported “unable” (and then becomes a sell limit order).

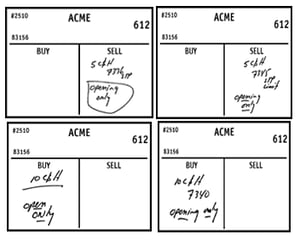

Opening-Only Orders

An opening-only order may be a market, limit, stop or stop limit order that instructs the broker to fill the order during the opening. These orders must be filled at a price within the opening range of prices. An opening-only market order must be filled; however, any of the other types of opening-only orders may or may not be filled, depending on whether the broker was able to fill them.

The opening range for the following examples in March Canadian Dollars is .7340 to .7344.

Can you tell which of the four opening-only orders should have been filled?

OCO Orders (One Cancels the Other or Order Cancels Order)

An OCO order involves the entry of two separate orders. If one order is filled, the other is automatically cancelled. The broker is given both orders so that each can be filed in the appropriate place in his deck. The member firm employee must be sure to get both orders back from the broker when one is filled, checking to be sure the other order has been cancelled and not filled in error.

The above orders tell the broker to buy 1 Feb Live Cattle at 65.17 or better. If this is not possible, then buy 1 at the market on the close. Whichever order is filled, the other is cancelled.

MIT Orders (Market-If-Touched)

An MIT order to buy becomes a market order if and when the commodity trades, or is offered, at a specified price or lower; an MIT order to sell becomes a market order if and when the commodity trades or is bid at a specified price or higher. An MIT order differs from a limit order in that the order becomes a market order once the MIT price is reached. The order must be filled, even if the market takes a turn in the opposite direction.

In our example, the order reads to sell 7 June Deutsche marks 64.83 MIT. Let’s say that a trade occurs at 64.83 then the next three trades are 64.82, 64.81, and 64.80. Our order is filled at 64.81. This would not be the case with a limit order to sell 7 June D-Marks 64.83. We would not necessarily have a fill at 64.83.

FOK Orders (Fill-Or-Kill)

A FOK order instructs the broker to make one attempt to bid or offer the order and, if not filled immediately, cancel the order. The customer placing the order may be on the telephone while this attempt is made, thereby making it necessary for the runner to wait for the broker to try to fill the order and then notify the phone clerk of its status. FOK orders are written very close to current trading levels and should be delivered to the broker without delay.

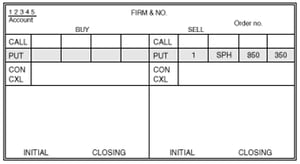

Option on Futures Orders

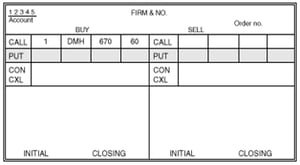

An option on futures order is written in a format similar to that of a futures order, with the addition of the strike price and the put/call indicator.

The above order reads “For account 12345, buy 1 March Deutsche mark 670 call at .60.

This order reads, “For account 12345, sell 1 March S&P 850 put, at 3.50. Consult your broker before entering any trade.

The information compiled here is from sources believed to be reliable, but we cannot be held responsible for either its accuracy or completeness.